401k Contribution Limits 2025 Irs

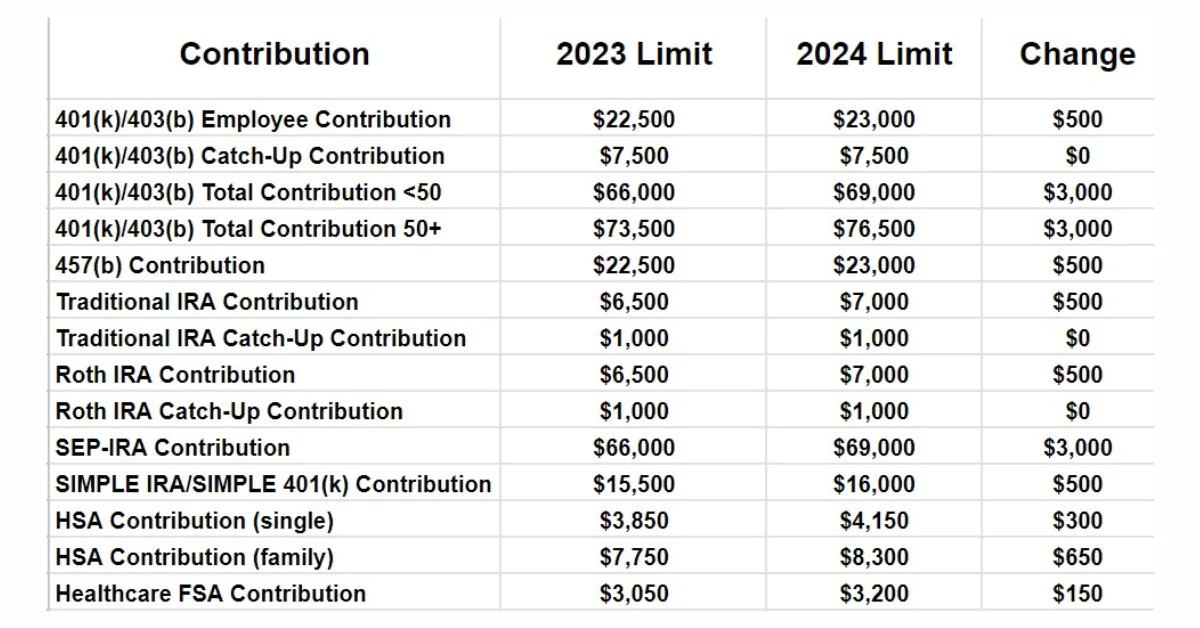

401k Contribution Limits 2025 Irs - 401k Contribution Limits And Limits (Annual Guide), The 401 (k) contribution limit is $23,000 in 2025. The overall 401 (k) limits for. 401k 2025 Contribution Limit IRS Under SECURE Act 2.0, Annual 401(k) contribution limits in 2025, the maximum contribution for workers who take part in most 457 plans, 403(b), 401(k), and the federal government's thrift savings. The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to a cost of living adjustment and is an increase from $22,500 in.

401k Contribution Limits And Limits (Annual Guide), The 401 (k) contribution limit is $23,000 in 2025. The overall 401 (k) limits for.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov. Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

This limit includes all elective employee salary deferrals and any contributions made to a.

401k Contribution Limits 2025 Irs. The irs sets a limit on how much can be put into a 401(k) plan every year, also known as an annual contribution limit. Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

Irs Limits 401k 2025 Rene Vallie, For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. In 2025, people under age 50 can contribute $23,000.

The IRS Announces New 401(k) Plan Limits for 2025 Sequoia, The 401 (k) contribution limits for 2025 are $23,000 for individuals under 50, and $30,500 for those 50 and older. For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

The 401 (k) 2025 employee contribution limit is $23,000, which is an increase of $500 from the previous year.

2025 Irs Contribution Limits 401k Mavra Sibella, The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to a cost of living adjustment and is an increase from $22,500 in. For 2025, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000.

For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. The 2025 individual 401 (k) contribution limit is $22,500, up $2,000 from 2022.

IRS Announces New 2025 401(k) Contribution Limits Explaining Finance, The 401 (k) contribution limit is $23,000 in 2025. This limit includes all elective employee salary deferrals and any contributions made to a.

The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits for ira.

401k 2025 Contribution Limit Chart, The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025). In 2025, people under age 50 can contribute $23,000.

Irs 401k Contribution Limits 2025 Agna Lorain, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. Annual 401(k) contribution limits in 2025, the maximum contribution for workers who take part in most 457 plans, 403(b), 401(k), and the federal government's thrift savings.

401k 2025 Contribution Limit Irs Catch Up Rasia Catherin, The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2025 to $23,000 in 2025 (compare that to the. This amount is up modestly from 2025, when the individual 401 (k).